Get your brain in synch for better investment outcomes

Why do people fail at investing? They get in their own way, trading into or out of positons at the wrong time. They do not follow a sound methodology, inviting doubt when the going gets rough. Or they cobble together a mix of investments they know little about that act in unexpected ways or represent excessive risk.

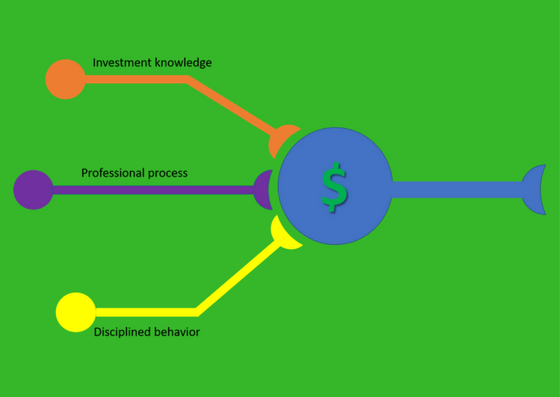

What personal investors need is knowledge, a sound process and the psychological insights to avoid self-sabotaging their own portfolios. The Investment Synapse is where these elements come together to activate the full potential of your investment portfolio!

Your investment synapse

|

A synapse is the space between brain cells where signaling and communication takes place. It is the place where different inputs come together to generate a particular output. The brain cell receiving the signal is only adequately "activated" when the signal across all synapses is strong enough. This usually requires the coordinated, synchronized signaling of multiple inputs. One single input alone will not be effective. |

Brain cells integrate information from multiple inputs to perform optimally Brain cells integrate information from multiple inputs to perform optimally |

Likewise, a successful personal investment program requires more than a cute strategy or reading the Wall Street Journal. Your personal investment program should be based on sound theory (the knowledge element), an institutional-grade process (the methodology element) and psychological discipline (the behavior element).

Use your brain to synchronize the critical inputs and activate your investment potential

Use your brain to synchronize the critical inputs and activate your investment potentialThe three elements described:

Knowledge: We explore the building blocks of a successful portfolio:

- Familiarity with the different types of investments, called asset classes, and their characteristics such as liquidity and risk and reward potential.

- The basics of Modern Portfolio Theory and it's successor theories. This includes the key statistics used to evaluate an investment, portfolio or investment manager.

- Common investment strategies and styles including active versus passive investing, fundamental versus technical analysis and thematic investing such as socially-responsible or impact investing.

Methodology: Applying an institutional-grade investment process for your personal portfolio. Starting with your own purpose statement or philosophy of wealth, we move through the steps and tools commonly used by professional investors to develop a long-term investment strategy and a clear plan to monitor and revise the plan as your circumstances change.

Behavior: Behavioral psychologists and neuroscientists have characterized many of the biases and cognitive errors investors may be prone to that can thwart our best intentions and devices. The best investment plan can be rendered ineffective by poor execution. An understanding of how the brain makes decisions under uncertainty and a survey of the biases you may personally be susceptible to should inform and guide your investment plan, fortifying it with a disciplined mindset.

What the investment synapse can do for you

The Investment Synapse helps you understand each of these three elements and how to integrate them into a comprehensive, holistic and coherent investment plan.

Comprehensive, because the Investment Synapse covers the wide range of investment types, the vehicles they are commercialized in, and various investment strategies.

Holistic, because the Investment Synapse helps you place your investment portfolio within the context of your values, aspirations and temperament.

Coherent, because the Investment Synapse shows you how an optimal portfolio synchronizes each of the investment elements such that each element reflects and depends on the others and does not create contradictions between them.